gambling income tax calculator

In New York state tax ranges from a low of 4 to a high of 882. Gambling Income Tax Calculator - Best Online Slots.

New York Gambling Winnings Tax Calculator Empirestakes Com

Professional Gambler Tax Calculator - Estimate the tax impact of filing as a Professional or Recreational Gambler.

. Looks like this move could have a negative net change in disposable income. This calculator is not appropriate for. More than 5000 in winnings reduced by the wager or buy-in from a poker tournament.

The operator will use a gambling winnings calculator to determine the amount of tax you will pay after winning a big jackpot. Any winnings subject to a federal income-tax withholding requirement. Gaming revenue in New Jersey used to be the primary source of funding for the Casino Revenue Fund CRF which pays for programs critical to seniors and those with.

Gambling winnings are considered taxable income by the IRS and you should always. Its determined that gambling losses are a miscellaneous deduction. Gambling winnings are subject to a 24 federal tax rate.

The amount of losses. The state tax rate in Michigan is 425 which is the rate your gambling winnings are taxed. Other Resources - Other information related to gambling taxes.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Illinois attempted to pass a graduated income tax amendment but voters denied it in November 2020. 31 2019 taxes on gambling income in Illinois are owed regardless of what.

What are the NY Gambling Tax Rates. 600 or more on a horse race if the win pays at least 300 times the wager amount. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

There are two main tax benefits of filing taxes as a professional gambler. In November 2020 Nebraska Department of Revenue is issuing a new Nebraska Circular EN for 2022 169. Yes gambling winnings fall under personal income taxed at the flat Illinois rate of 495.

This will display 2 figures the tax paid on your gambling winnings and the amount you can keep from your gambling winnings. First it allows you to net your wins and. Caesars Online Casino Game- Play Play Slots Play The Casino Game Now.

Calculate the Net Tax CostBenefit of Filing as a Professional Gambler. Winnings are subject to both federal and state taxes. The answer here is also Yes permitted and regulated daily fantasy sports DFS.

The cost of living in Newark NJ is 256 higher than in Columbus OH. When gambling winnings are combined with your annual income it could move you. You may deduct gambling losses only if you itemize your deductions on Schedule A Form 1040 and kept a record of your winnings and losses.

For example if players win 150000 but lose 50000 in bets the taxable income allowed as a miscellaneous deduction. Maryland levies between 2 and 575 in state taxes including gambling winnings. You will pay gambling tax as you file income taxes.

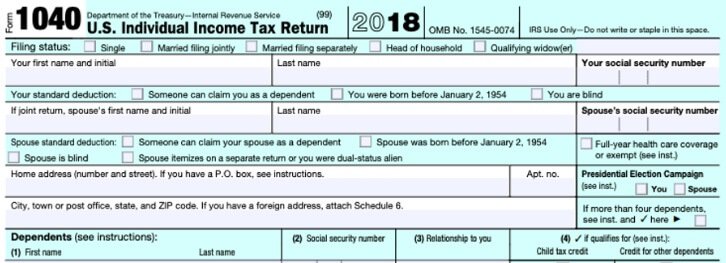

Gambling income is almost always taxable income which is reported on your tax return as Other Income on Schedule 1 - eFileIT. This calculator computes only an estimate of the income tax on gambing winnings for individuals with fairly straightforward tax situations. Tax calculator assumed a standard deduction of 12400 single24800 married and does not include any municipallocal taxes.

Just like other gambling winnings lottery prizes are taxable income. One small consolation is PAs 307 state tax on lottery winnings is less than half than neighboring states such as New York. In Arizona the Lottery is required by law to withhold 24 for federal taxes and 48 for state income taxes for.

The actual amount you will owe in tax liability will depend on your tax bracket and could be lower or higher. Currently Illinois has a flat tax rate of 495 for all residents. The tax code requires institutions that offer gambling to issue Forms W-2G if you win.

Taxable Gambling Income. The state passed a law that states that all winnings received after 2017 and that are more than 5000 have a 24 percent federal gambling tax rate. Gambling winnings are subject to 24 federal tax which is automatically withheld on winnings that exceed a specific threshold see next section for exact amounts.

If your winnings are. Players should report winnings that are. 2022 Most Exciting Online Slots.

If youre a full-time.

Gambling Winnings Are Taxable Income On Your Tax Return

Crypto Gambling Taxes Bitedge Helping You Win

Filing Out Of State W 2g Form H R Block

5 Things To Know About Taxation Of Gambling Income Scholarly Open Access 2022

Tax Calculator Gambling Winnings Free To Use All States

Gambling Winnings Tax H R Block

Simple Tax Refund Calculator Or Determine If You Ll Owe

Gambling Taxes How Does It Work And How Much Does It Cost

Online Sports Betting Taxes How To Pay Taxes On Sports Betting

Reporting Gambling Winnings And Losses To The Irs Las Vegas Direct

How Much State Federal Tax Is Withheld On Casino Winnings

Tax Calculator Gambling Winnings Free To Use All States

Paying Taxes On Gambling Winnings Do I Need To Pay Taxes On My Wins

Lotto Winnings Tax Calculator Factory Sale 50 Off Www Vetyvet Com

Colorado Gambling Tax Calculator Paying Tax On Winnings

Free Gambling Winnings Tax Calculator All 50 Us States

Crypto Gambling How It S Taxed Koinly

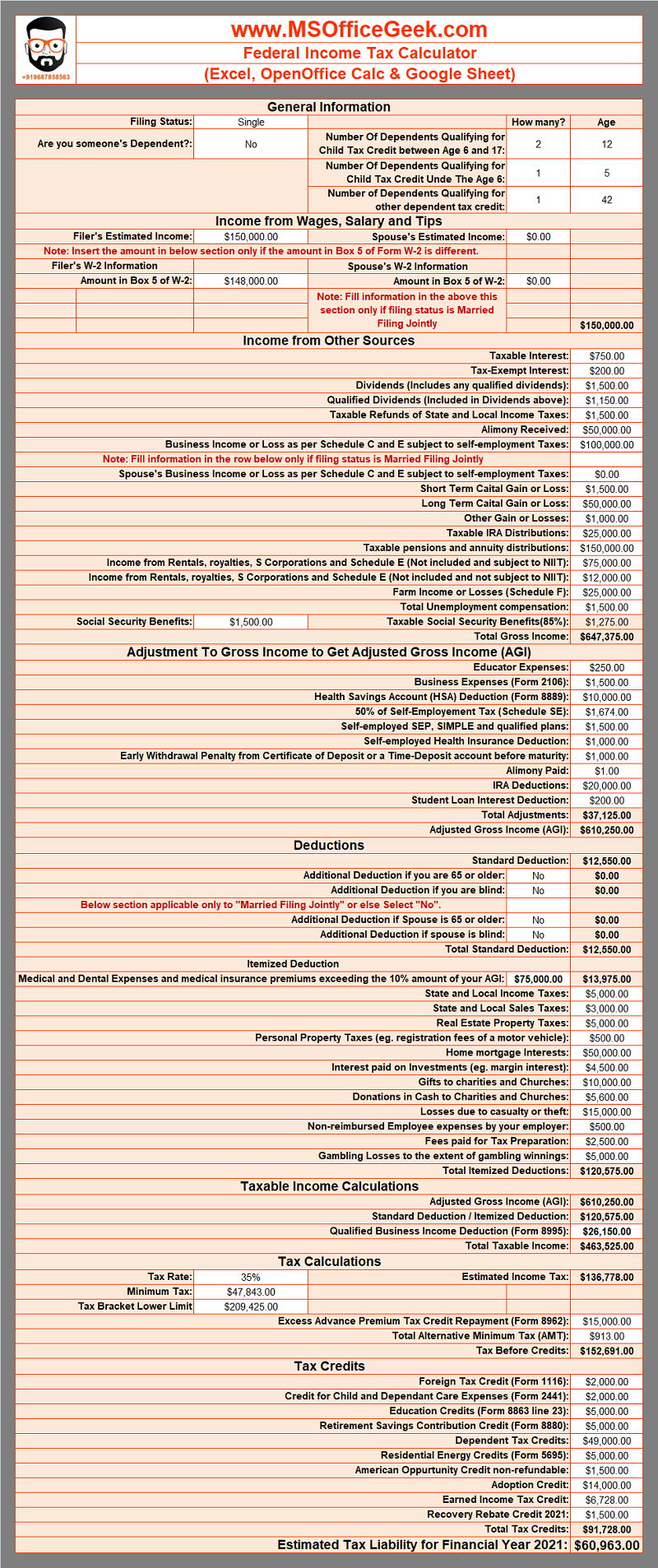

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek